By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

A Brief History of Interest Rates

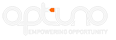

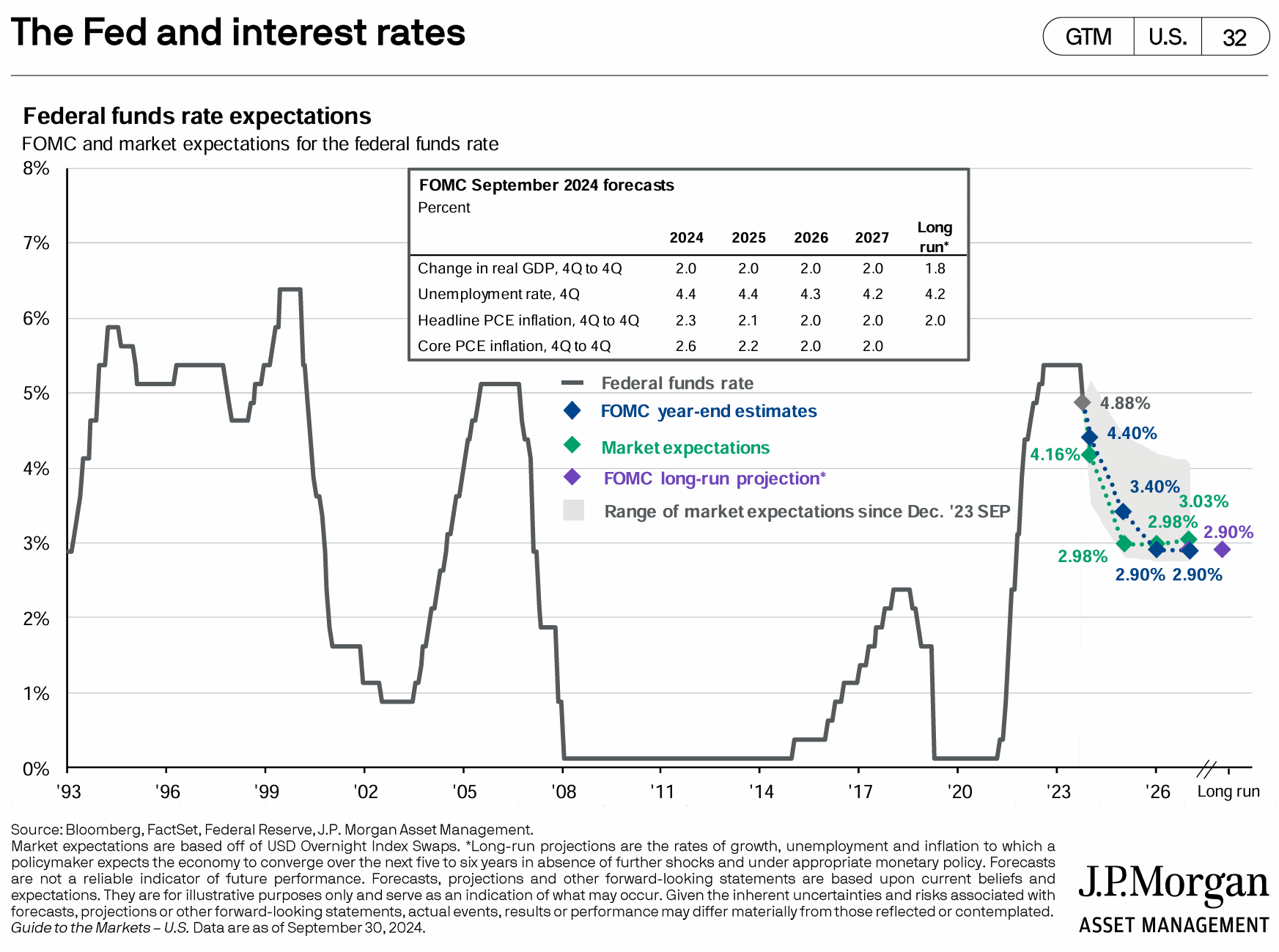

The Federal Open Market Committee voted in September to lower the federal funds rate by 50 basis points, or 0.5%. This rate cut marks the beginning of a dovish turn for the Fed, after a sharp and historically swift spike in rates to combat post-COVID inflation. How much and how quickly did rates rise? 5.25% in a less than 2 years, as per Forbes’s Michael Adams:

Source: Forbes.com

Source: Forbes.com

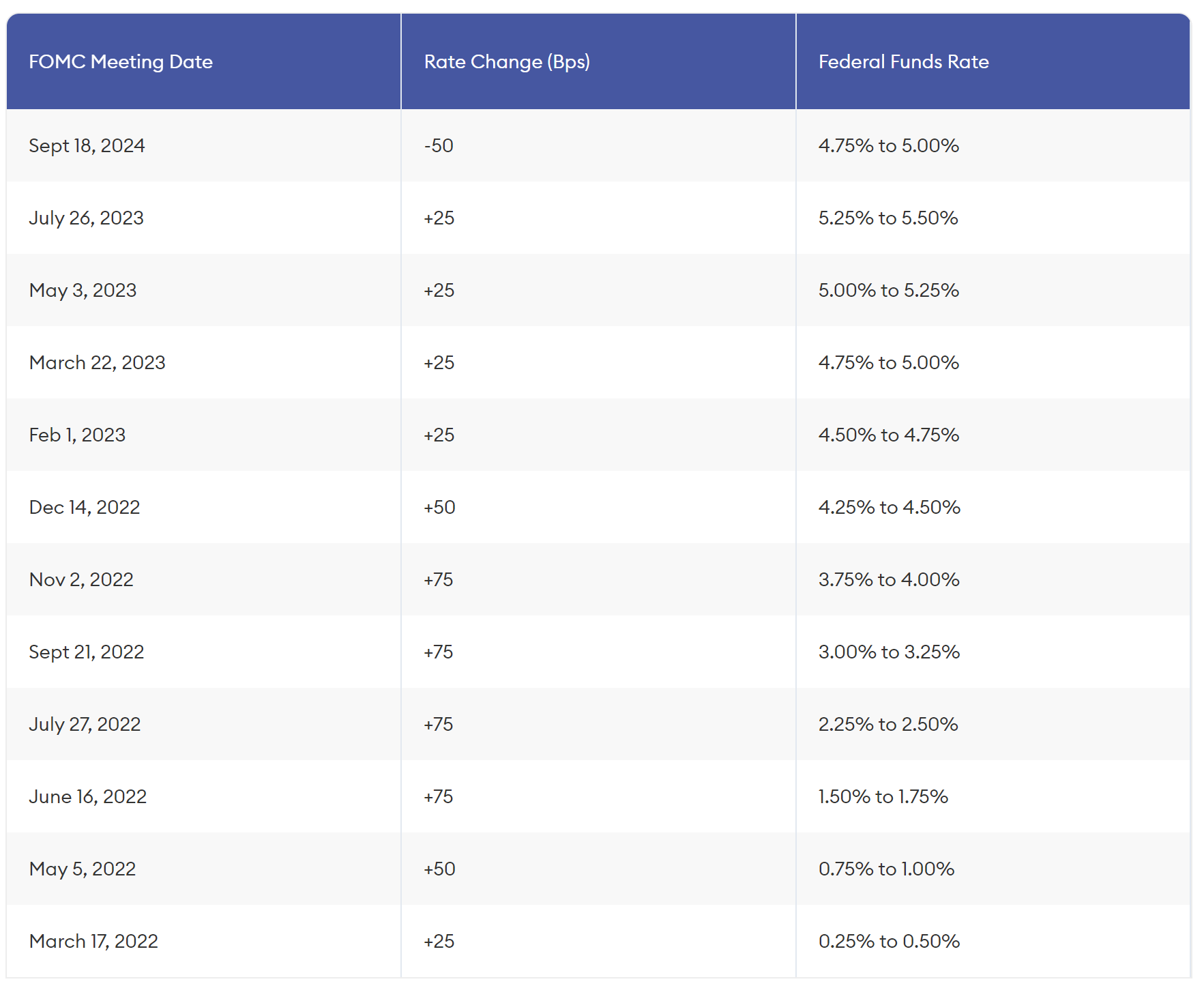

To get perspective on how quickly the Fed hiked its target rates, we can view this graph from the St. Louis Fed:

The rate hikes of 2022-2023 were the steepest we’ve seen in over three decades. Fortunately, inflation cooled significantly and has been approaching the Fed’s 2% target, thereby enabling the Fed to start easing monetary policy. However, the pace and scale of rate cuts will still depend on inflation data, labor market data, and other economic data.

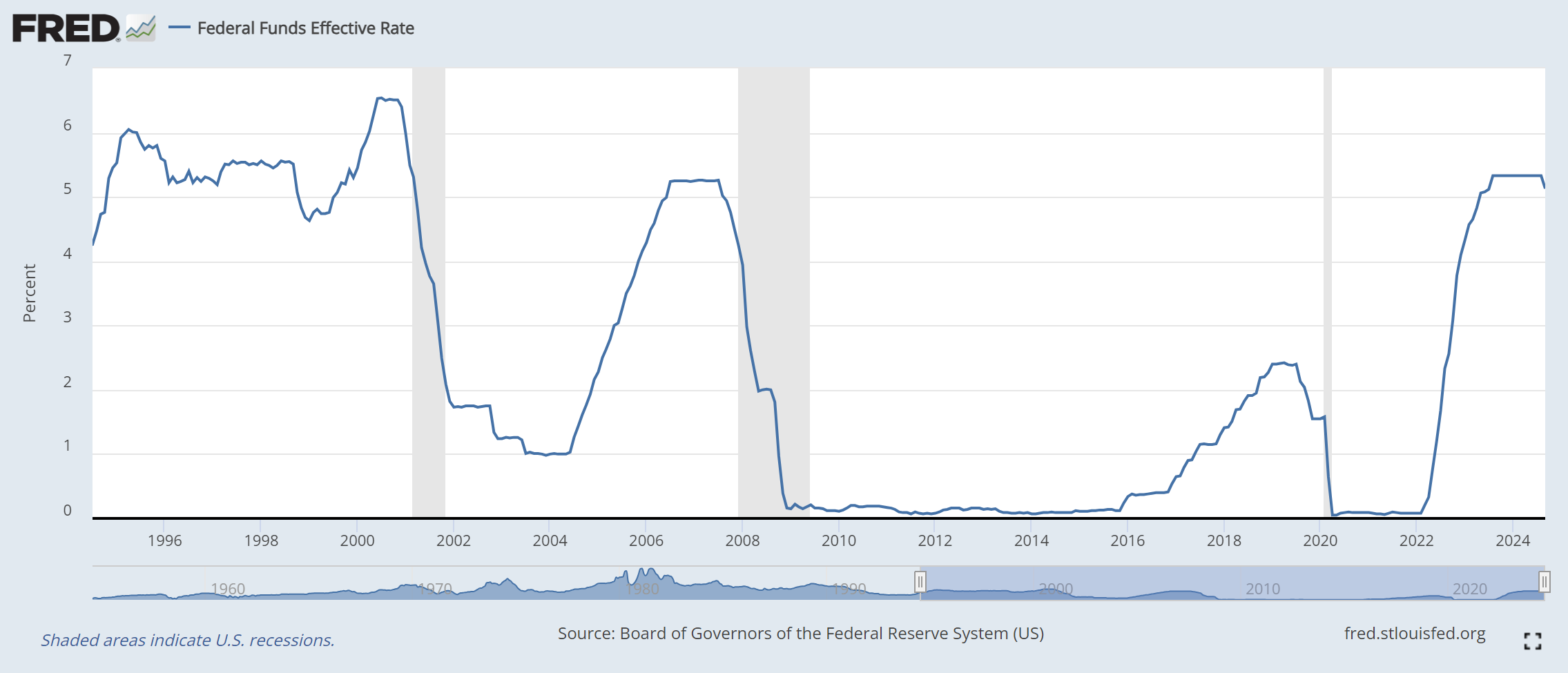

Mortgage rates have also eased as markets anticipated the Fed’s dovish pivot.

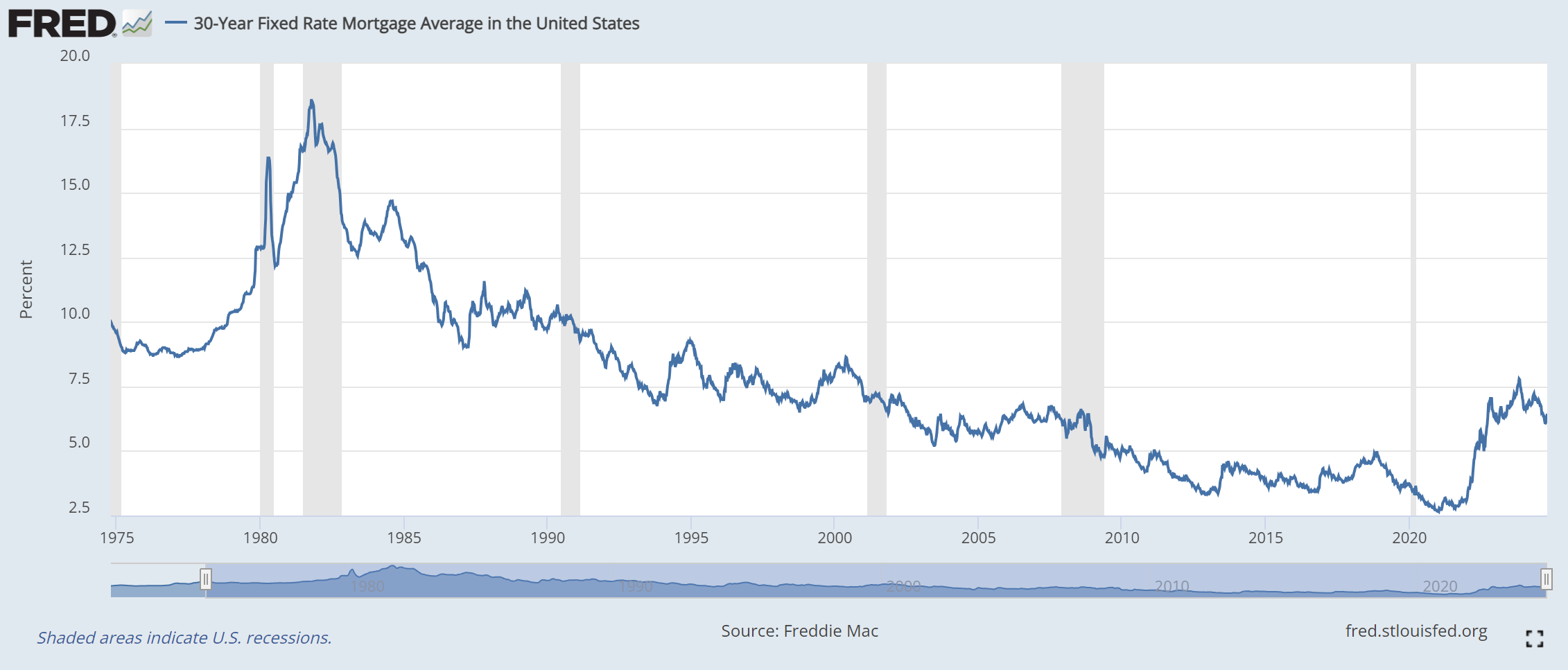

From October of 2023 to September of 2024 the U.S. 30-year fixed rate mortgage average fell from 7.79% to 6.08%, though it has crept up to 6.44% in October. While these mortgage rates are certainly high when compared to the ultra-low rates we saw in the 2010s, a longer lookback provides deeper context:

Thankfully, mortgage rates have left the 1980s behind; current rates are comparable to those found from 2000-2008. There is the possibility of rates dropping further, given that the Fed is anticipating making additional rate cuts:

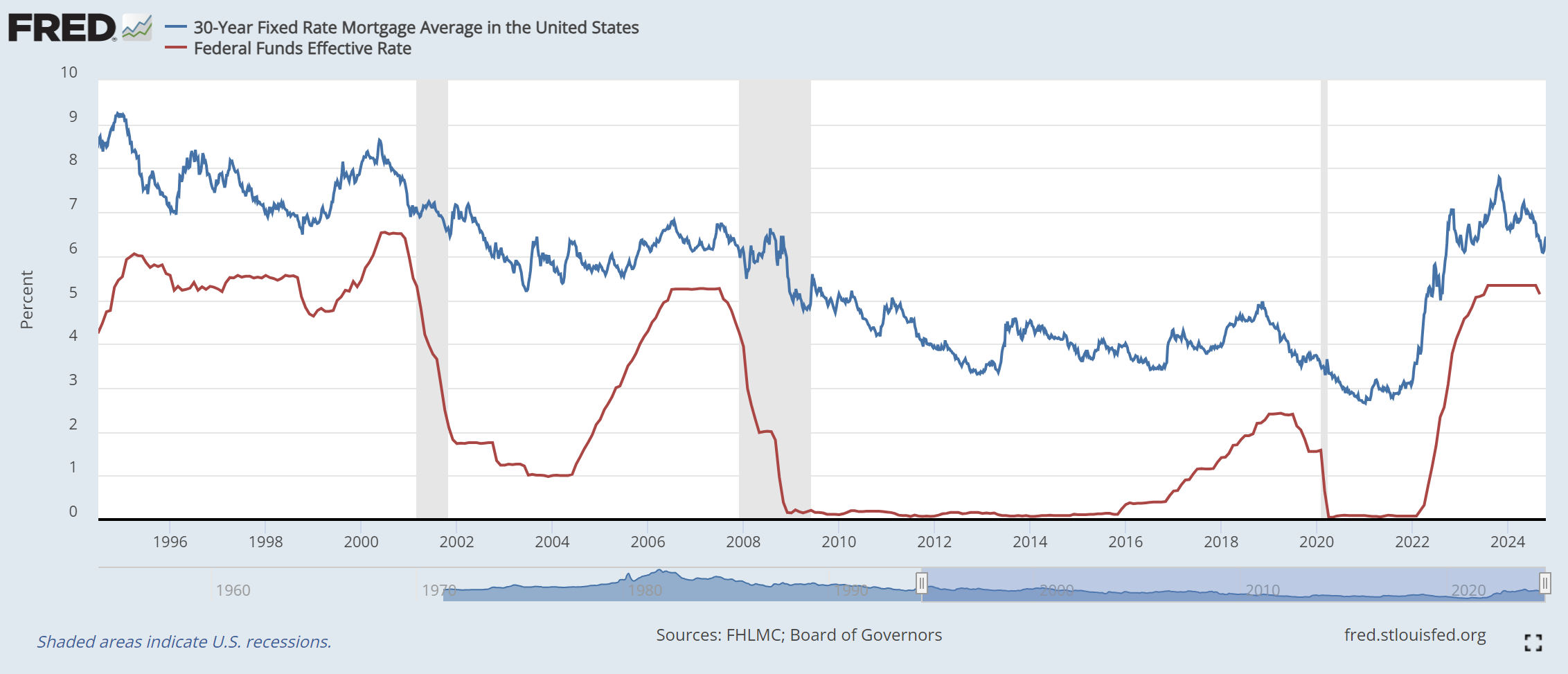

Both the Fed and markets expect the federal funds rate to fall about 2% over the next 2 years. Past history suggests that if the Fed keeps cutting rates, mortgage rates will continue to fall:

However, while the federal funds rate and mortgage rates have tended to move in tandem, steep movements in the federal funds rate have typically been accompanied by more modest movements in mortgage rates. So even if the Fed cuts rates an additional 2% by 2026, we would project mortgage rates to fall by a smaller amount.

There’s also the possibility of unexpected economic events. Inflation could reemerge—fiscal policy is currently stimulative, deficits are high, and neither Donand Trump and Kamala Harris are campaigning on fiscal conservatism. Or economic conditions could revert back to those found in the 2010s, and ultralow rates could prevail once again. Mortgage rates are in a better place for buyers than they were a year ago, and there’s reasonable grounds for optimism for a more benign rate environment, but only time will tell.

‹ Back