By using our website, you agree to the use of cookies as described in our Cookie Policy

Blog

Electoral Aftermath

Elections have consequences. Donald Trump’s election, along with Republican control of the House and Senate, and a 6-3 conservative majority in the Supreme Court, is likely to have far-reaching consequences. In this piece we’ll give our initial impressions of the impact of Trump’s election on the economy, with a particular emphasis on real estate. With few specific tea leaves we can read, we’ll be focusing more on broader economic forces.

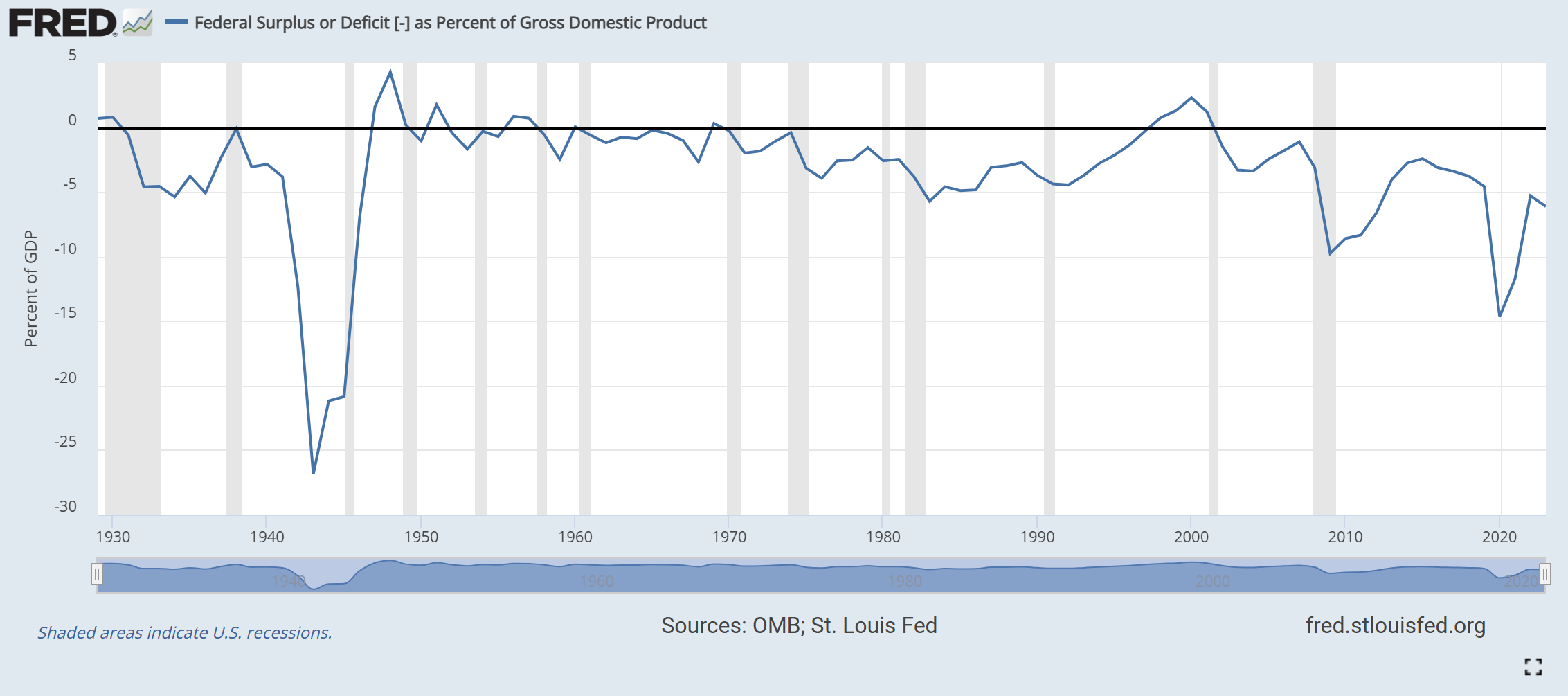

After falling for much of the year, interest rates began to rise again in October as Trump’s polling improved, and have risen further after the election. The 10-year Treasury rate and 30-year Treasury rate have climbed about 70bp and 50bp, respectively, since October 1st. One plausible explanation for these rate increases is that markets anticipate that the Trump Administration will pass further tax cuts which will cause already high deficits to swell even further.

In response, the Fed may keep monetary policy more restrictive than previously anticipated.

Many of Trump’s other policies also carry the risk of increasing inflation. Tariffs are likely to put upward pressure on the price of goods. Large-scale deportations of illegal immigrants are likely to put upward pressure on wages. If the threat of inflation grows the Fed may be reluctant to continue lowering the federal funds rate—indeed, market expectations have shifted to anticipating only a 75bp reduction from now through December of 2025. Trump may pressure the Fed into lowering rates, but even success on that front would run the risk of reinvigorating inflation. It seems highly unlikely that the ultra-low rates of the 2010s will return, but the path of rates is uncertain, as it is dependent on a number of forthcoming decisions by Trump, Congress, and the Fed.

The likely extension of the Trump tax cuts, including pass-through deductions, like-kind exchanges, and lower capital gains rates, should help commercial real estate. Trump proposals that affect the residential housing market would be more mixed. Deregulation should lower housing costs, but many regulations are state and local rather than federal in origin. Opening up more federal lands for housing may have a marginal impact, but these lands are typically in rural areas, while the housing shortage is most prevalent in urban regions. On the other hand, a crackdown on illegal immigration could raise construction costs by reducing the size of the construction workforce, which is heavily reliant on immigrant labor. Tariffs would also likely raise the costs of some building materials, such as lumber.

Economic forecasting is extremely difficult, and even more so in an environment of potential mass deportations and a tariff regime that, depending on their levels, exemptions, and retaliatory responses from other countries, could have enormous implications for all sectors of the economy. We don’t know what Trump will do if inflation starts to rise again, or if the agricultural and construction industries sound the alarm that the immigration crackdown is decimating their workforce. We would expect some benefits from lower taxes for the real estate industry and broader areas of the economy, but we no longer have the economic slack that we had in 2017—at some point we expect to see tension between fiscal/tariff/immigration policy, inflation, and interest rates, and it's unknowable at this time how such tension will be resolved.

‹ Back